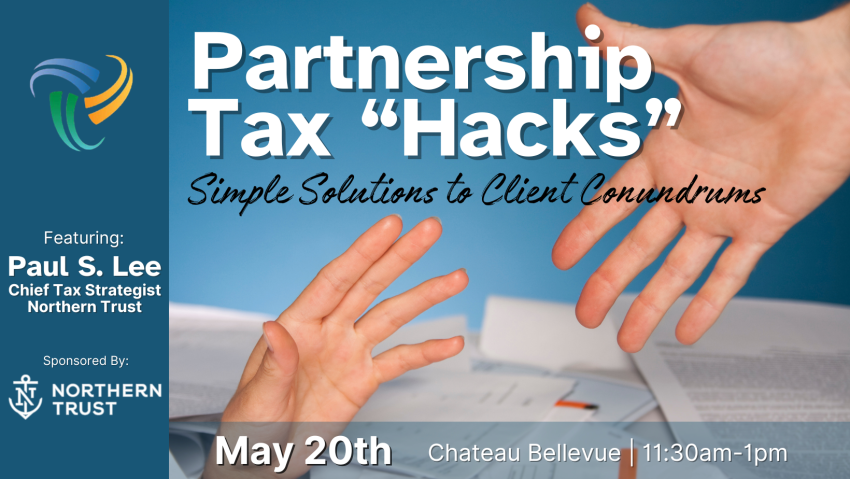

May Luncheon: Partnership Tax “Hacks” (Simple Solutions to Client Conundrums)

Registered for this event? Login now to view additional event details.

Join us on May 20 from 11:30AM - 1PM at Chateau Bellevue [708 San Antonio St], to learn more about Partnership Tax 'Hacks' with guest speaker, Paul S. Leeo.

An entity taxed as a partnership (or disregarded entity) is the most flexible tax planning tool for practitioners, but with that flexibility comes complexity in the form of Subchapter K of the Code. This presentation will discuss partnership planning ideas that: (i) address common and identifiable client situations, (ii) are understandable, straightforward, and actionable; and (iii) provide superior results for clients.

About Our Speaker: Paul S. Lee

Paul is the Chief Tax Strategist for Northern Trust Wealth Management. In this role, he leads research and strategy development as it relates to tax issues and wealth planning. Paul specializes in advising and consulting with ultra-high-net-worth families and their businesses, with a focus on complex income, transfer, and international tax issues.

Prior to joining Northern Trust in 2015, Paul served as National Managing Director of Bernstein Global Wealth Management in New York. He began his career practicing law and became a partner in the Tax, Estate Planning and Wealth Protection Group at Smith, Gambrell & Russell, LLP in Atlanta.

He received his J.D. and LLM (Taxation) degrees, with honors, from Emory University School of Law, and B.A. degrees, cum laude, in English and Chemistry from Cornell University. Read more

SPONSORED BY:

Parking: Parking is available complimentary onsite.

Photo Disclaimer: By attending this event, you acknowledge that you are aware your image may appear in on EPCCT social media platforms, promotional material and other media as requested. Questions: contact Jen George, CAE at atxEPCCT@gmail.com.

Menu: Special food requests cannot be guaranteed onsite. Please note any special dietary requirements or food allergies on the registration page.

Deadline to register or cancel is Friday, May 16 at noon. Guarantees to the venue necessitate this policy.

New Guest Policy: Guests may attend our meetings for $75/$78. Eligible guests who qualify for membership may attend once per program year before we ask them to join.

**MEMBERS: PLEASE LOGIN TO REGISTER.**

Login now to see a list of event attendees.